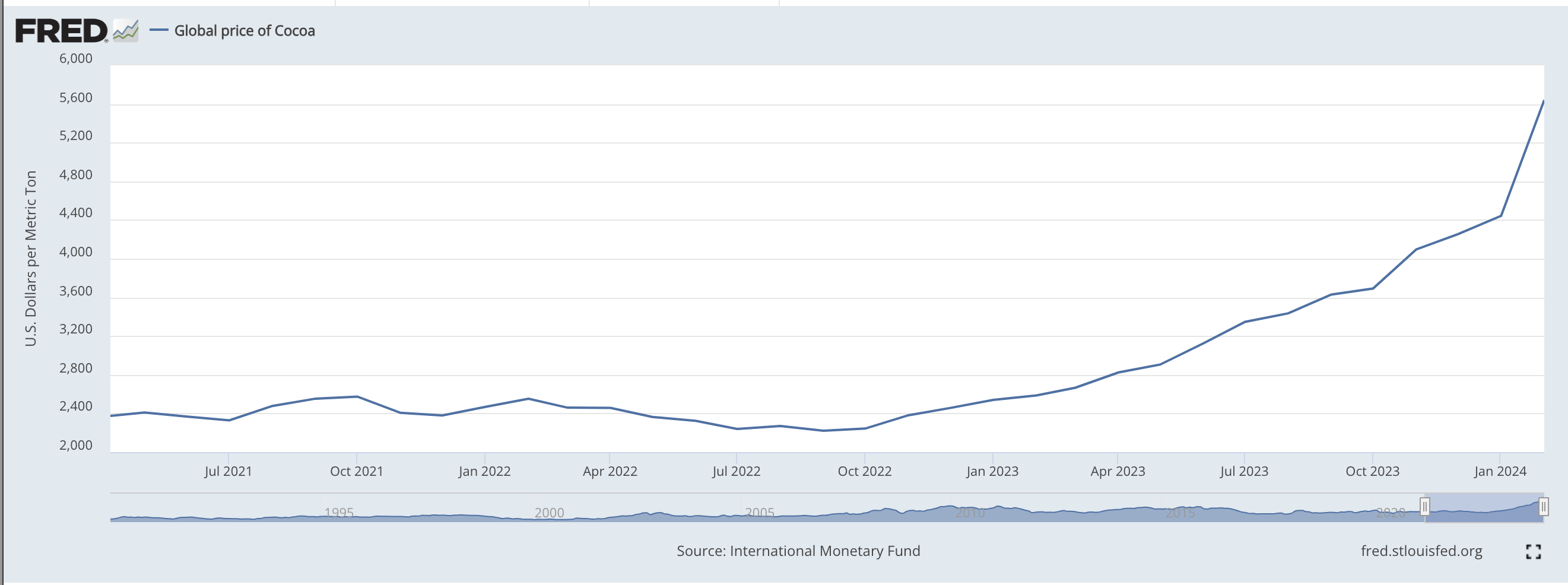

IT'S THE CHOCOPOCALYPSE! Cocoa prices are up 150% since a year and a half ago, and the chart is starting to look exponential.

Resolves YES if the global price of cocoa, per metric ton, is reported as $10,000 or higher for any month in 2024.

Resolves NO otherwise.

I will wait until all months are available in the FRED dataset to resolve.

https://data.imf.org/?sk=471dddf8-d8a7-499a-81ba-5b332c01f8b9&sid=1547558078595

$10412 for December

Should update on FRED eventually as the IMF data source is already updated…

@DanMan314 Bit hard to reproduce the numbers that end up on FRED, but the data it's supposedly based on is here: https://www.icco.org/app/statistics/

If you manually average the daily figures for a calendar month it doesn't always agree with the monthly average they publish though, and then what ends up on FRED is slightly different again. Doesn't really make a lot of sense. February does exactly agree though.

Anyway this is looking like a NO - the April number will probably be a few hundred dollars short of 10k. But given the discrepancies I wouldn't bet the farm on it.

mean ICCO daily | ICCO monthly | FRED

-------------------------------------------

JAN | 4440.37 | 4452.60 | 4442.92

FEB | 5640.09 | 5640.09 | 5640.09

MAR | 7435.43 | 7435.43 | 7295.95

APR | 9876.58 | 9876.58 | ????.??@chrisjbillington I saw this too, thought that the IMF might use a different forward rate adjustment methodology (pre vs post agg). In reality seems more likely that someone is doing something in excel (dropped day?)

Depends on whether inflation will lead to a feedback loop between hyperinflation and onshoring of USD. A price can be one thing, but if demand collapses the question becomes will they have to charge more to make up the loss of customers. At current prices, and looking at the consumer credit markets, I don't see demand collapsing, even as cost of living rises dramatically. Pricing based on inflation is doubling at least once a year.

I vote a tentative yes, but if I had my druthers I'd put the actual date more toward mid 2025.

May futures have already touched the $10k mark.

https://www.cnbc.com/2024/03/26/cocoa-prices-hit-10000-per-metric-ton-for-the-first-time-ever.html

@voodoo haven't read the FRED methodology, but don't think that any central measures for the month would be over 10k & the following months are in contango.

@TrentonPotter Contango in a supply crunch like this is just a bullish indicator. Eventually the parabola will top out but I wouldn't bet on it happening now. Anyway, we need a $12k/ton market.

@HarrisonNathan sorry, I've got brain rot. Meant backwardation. Expectations are downward sloping from front month (9.8k) onward.

https://www.cmegroup.com/markets/agriculture/lumber-and-softs/cocoa.html#venue=globex

@TrentonPotter Oy, same brain rot. I understood what you meant, not what you said. In a supply shock, the front month contract trades higher because there is a shortage on the spot market, so timely delivery comes at a premium. This doesn't mean the price will actually go down in subsequent months (though at some point it always does, for fundamental reasons).

@HarrisonNathan if expectations were that June spot is going to be >9.3k, you could buy the jun fut and profit.

@TrentonPotter Look at every commodity parabola ever and you will see the same pattern. The front month trades higher all the way up. It's not an indicator that the top is near.

@ian ‘bad weather, bean disease, and a lack of investment in new trees stretching back decades, recent cocoa harvests have been dreadful, resulting in a yawning gap between supply and demand.’