3/8/24: Current plan in case of multiple parties: If multiple parties get shares, I'll resolve in proportion to the stake of all non-Chinese parties who get more than 5% (i.e. a reportable ownership share), unless someone buys a controlling stake, in which case it'll resolve to them alone.

Here's a similar market but it's just a yes/no on each company or person owning a stake of the US version: https://manifold.markets/IsaacLiu/as-of-april-2025-will-the-following

If TikTok closes, creating a dedicated option to migrate content and subscribers to other platforms would be a very appropriate solution. This would help to preserve the achievements of users and simplify the process of transition.I by the way now want to develop my tiktok, I post a lot of videos, but there is no such a great result, no good audience and subscribers, what do you advise friends.

@TimothyJohnson5c16 Would be N/A given the title (which predated the Bill passing). I think a market with it shutting down as an option could also be interesting though!

@CalebW As part of the pivot, in another week N/A isn't going to be allowed. You have to pick YES or NO.

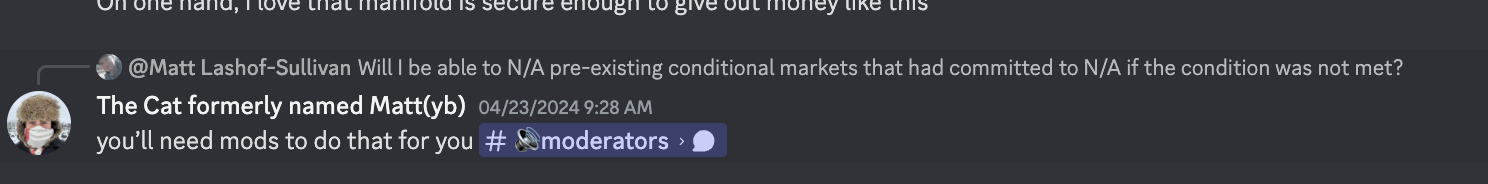

@TimothyJohnson5c16 I'm currently working under the assumption that I'll be able to N/A this if appropriate, even if a mod request is needed, given that changing this mid-market would be dramatically unfair to the people who have been betting under the assumption this only resolves on a sale

Seems like a lot of markets would be fucked if N/A is not grandfathered for existing markets tbh

@CalebW its a shame because I love making conditional markets, I think they're some of the best. They said they would come out with a new market style to better support conditional outcomes, so I'm looking forward to seeing that.

@Caleb I would encourage you to N/A this option, in my view it's a "poison pill" that conflicts with other options, because it's not mutually exclusive. If a new US publicly traded entity was created, either the companies or individuals that invested in that entity should resolve YES, or the actual name of the entity should resolve YES if nobody has over a 50% in stake in it.

People who think will happen would be better off buying "Other" until the company or its investors are announced.

Another example: it wouldn't be right for me to add the answer "A U.S. company", because that would conflict with pretty much all of these and since only 1 can resolve YES, this woulds mess up the whole market. cc @alexlitz

@mint Looks like I might not be able to N/A added answers for linked multi choice? For now I agree with your interpretation, and will likely edit this answer to clarify it won't be resolved to.

For further clarity - it seems plausible that Bytedance creates a new entity or holding company for TikTok, which is then divested or IPO'd. The spirit of this question would be to see who buys that entity rather than resolving to the entity itself.

@costlySignal Open to other suggestions, but I'm thinking it will be most straightforward to resolve based on what is actually, finally executed (i.e. if the FTC scuppers a purchase, it won't resolve to that buyer)

@Caleb can you what would happen if one American company buys 51% and another American company 49%? The beginning of the resolution criteria makes it sound like you would resolve 51/49, but at the end you say:

unless someone buys a controlling stake, in which case it'll resolve to them alone.

which doesn't seem to make much sense and contradicts the first part?

@mint Yeah maybe in hindsight it was silly or unnnecesary to have this exception, but I'm inclined to let it stand given the amount of betting already underway. At the time, it struck me that a controlling stake would be worth singling out ¯\_(ツ)_/¯.