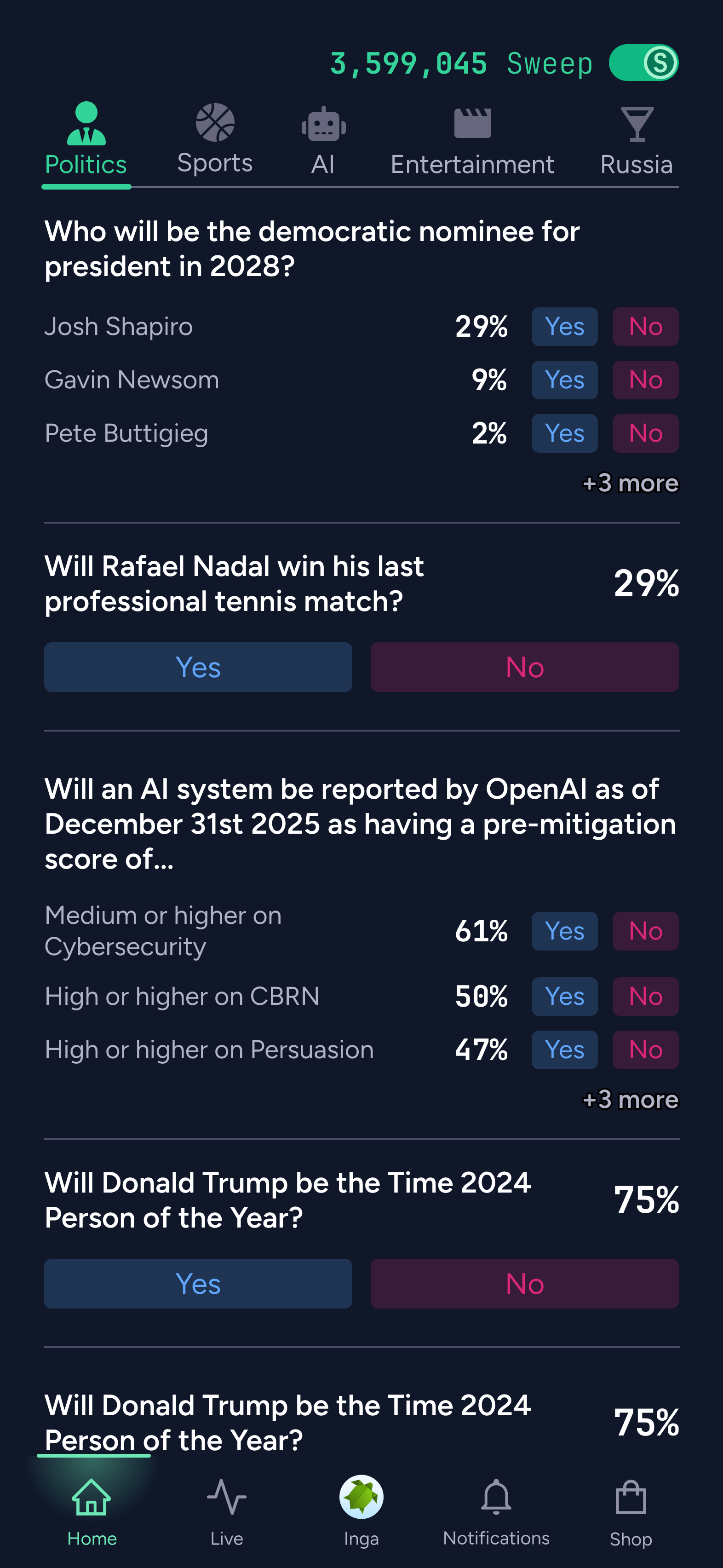

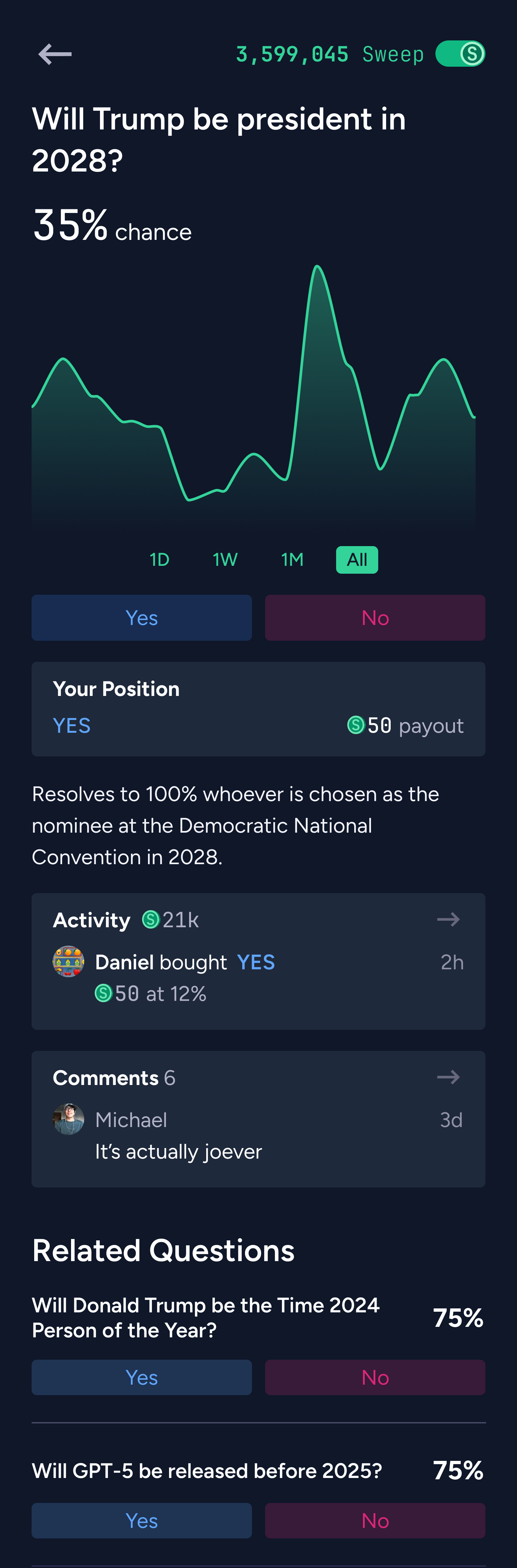

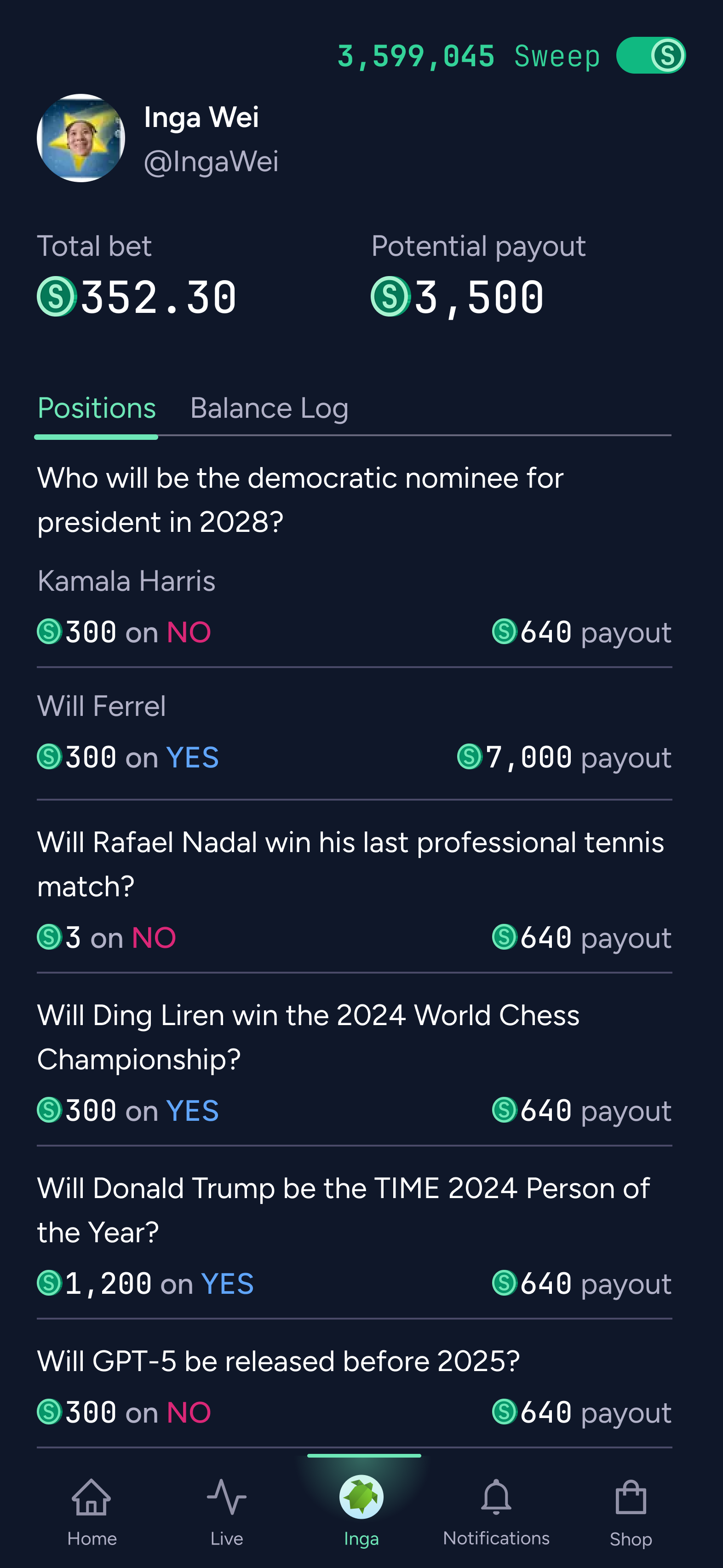

Needs to be cutesy, approachable, and not already taken by large company. Resolves to what we end up deciding to name it. Here's some mockups

@jim I don't agree with that. They picked Sweeple as the name for the app, and even though they didn't release it that doesn't affect the resolution.

@strutheo we are close to finalising, don't want to leak in case ppl try to snipe domains/socials.

<complaint>

Watching everyone buy NO for every decision disincentivizes traders from buying YES on the names they actually like. Expressing honest preference requires sacrificing profit in this market, I think. Is this generally true for all poll markets? Is part of this due to having a safe “Other” option?

</complaint>

@KimberlyWilberLIgt the thing is, there’s no resolution criteria here, so this market is mostly for suggestions and not trading

It should be called “Minifold Markets” (shortened to Minifold in normal use). That will make it easier for advanced newbs to “upgrade” to the pro version.

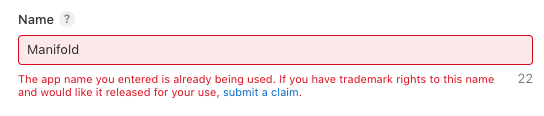

@KimberlyWilberLIgt "Hunch" by itself would be a great name, but alas is already taken on the app store.

@PaperBoy agreed. in the bet page, it's not clear how much you would gain and lose with a YES or NO outcome, and there's no way to switch your answer, for example.

When I first started out in prediction markets, I was confused by: "what would i gain/lose if this happened? what would i gain/lose if that happened?" I needed a more descriptive interface, not a slicker one w/ less options.

Questions I needed to understand as a new user that Manifold (still imo) doesn't answer well:

"How should I bet if I believe X?"

"When should I bet and when shouldn't I?"

"If I feel weakly about a belief, should I place bets more often with smaller amounts, or should I hold off on placing bets until I see an obviously mispriced market? Are there consequences to either approach?"

When thinking about usability for new users, ironically I feel like only allowing normies to place limit orders could be a good idea to explore.

Compared to betting against the marketmaker bot (which honestly I still really don't understand tbh), only allowing limit orders for the normie version has a couple important benefits that make those easier to understand:

It's always clearly apparent when you are and aren't betting against a human

What you win and lose is always apparent, and doesn't depend on the current market prediction -- either you win nothing or you win someone's money

Users can always express weakly held beliefs without fear of always losing something, increasing engagement.

Said another way, we always give them a "Yes" or "No" button that they can click on even if they weakly feel a certain way.

(When I was starting out, I only bet small amounts because I didn't want to lose too much. If I knew that I could always use limit orders like <98% or >5%, I would have used them waaay more than ordinary bets.)

When fulfilled, we could give users an exciting, easy-to-understand notification like

🔥You're On! Kimmy 🥊vs🥊 Otherperson -- @OtherPerson is now betting against you!🔥 so users know when their limit order is actually at stake.

Google's internal prediction market (Gleangen) works this way. They have "How likely do you think this event is?" [>X%] [<X%] sliders, and they had "How strong is your belief?" [1M - Guess], [5M - Hunch], [50M - Confident], [100M - Unshakable].

I would have found the entire concept of prediction markets way easier to understand with the above "You're On" framing of bets not being active unless someone wanted to challenge my limit order.

#unsolicitedadvice

upon further inspection I agree that these are simpler. I think I was just mistaking novelty for complexity. But I think it would make sense to focus on the percentage and then be like really key in on “higher vs. lower” a la The Price is Right. But maybe the assumption is that the best way to appeal to normies is to just focus on binary outcomes yes/no.

For a while, I thought that I was supposed to be betting at the current odds whenever I came across an interesting market.

I realized the most profits come when I make a bet when I think the current odds are wrong and I make a bet to "correct" the odds towards my believed odds (assuming that I actually have a calibrated world view).

Sometimes the best move is to not make a bet if the odds look about right. If a new interface causes people to bet "just because," I think I and many others would try to exploit that sort of trading behavior.