The state constitution of Texas has traditionally been interpreted to explicitly forbid both split-rate property tax and Land Value Tax. Split-rate property tax is any property tax regime where land and buildings are allowed to be taxed at separate rates, Land Value Tax is thus a subset of Split-rate property tax where the tax rate on buildings is 0%.

In the 1910's, J. J. Pastoriza, who would go on to be Houston's first Hispanic Mayor, insitituted a split-rate property tax in Houston, which was very nearly a full Land Value Tax:

https://twitter.com/larsiusprime/status/1427107150053183505

It got shut down, because of article 8 section 1, at least in one judge's opinion:

https://statutes.capitol.texas.gov/Docs/CN/htm/CN.8/CN.8.1.htm

It will probably take a ballot initiative to amend the state constituation to get split rate property tax passed in Texas.

If split rate property tax is unambiguously legalized in Texas through any means, ballot iniative or otherwise, then this market resolves YES. It doesn't mean that this reform must be mandated statewide, just that counties and cities will merely be allowed to enact the policy locally if they feel like it.

FYI, this isn't just a prediction, it's a goal -- I will be explicitly working to bring this policy outcome about. Bet on whether you think it'll happen within 5 years.

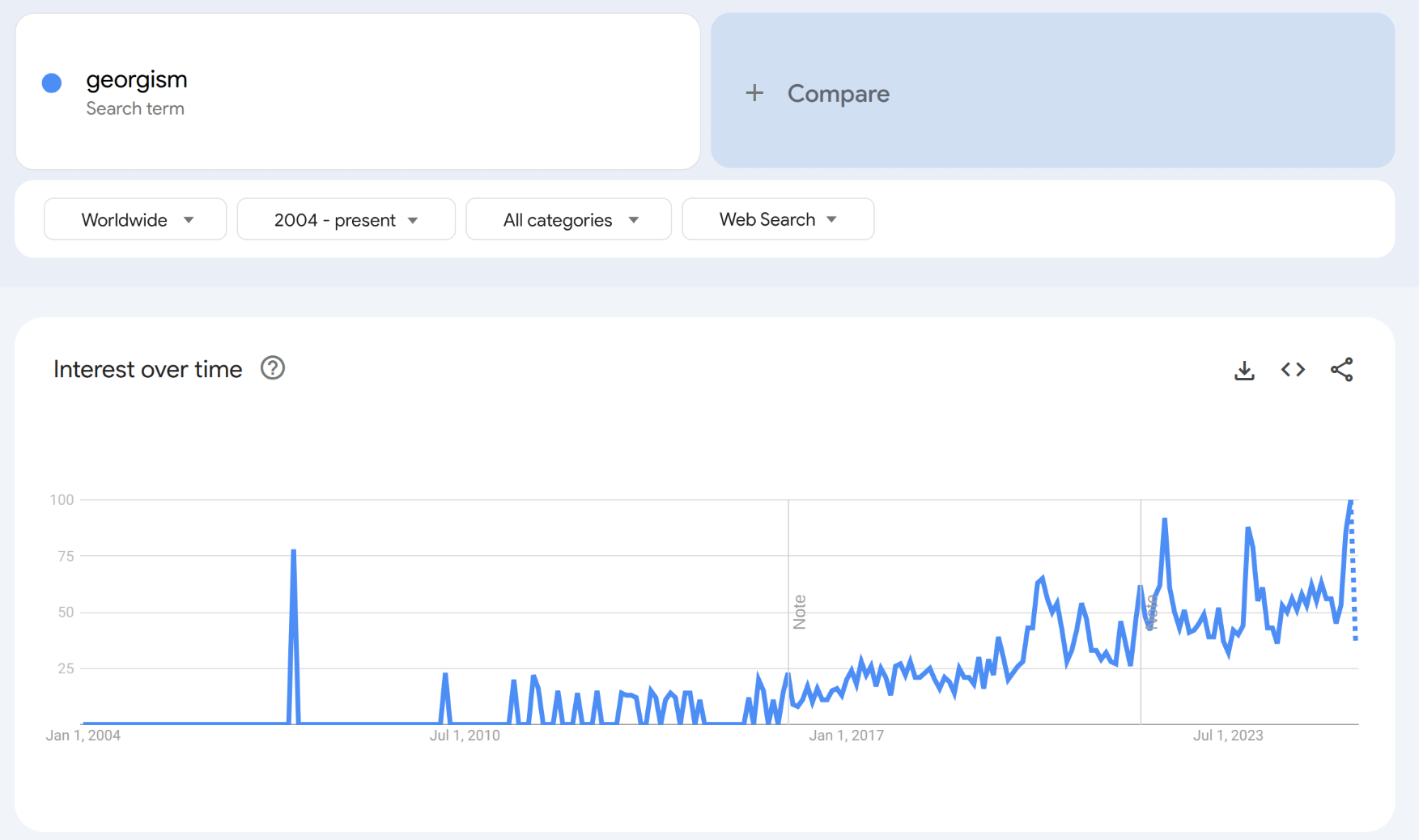

#Texas #Georgism #Politics #USPolitics

I will be explicitly working to bring this policy outcome about.

@LarsDoucet we're approaching 2.5 years, how's it going (godspeed and thanks to you btw!)? I see that you founded a new national organization https://progressandpoverty.substack.com/p/announcing-the-center-for-land-economics and that Texas is not mentioned in https://progressandpoverty.substack.com/p/the-lvt-landscape-1-movement-across is there any particular status update on Texas?

@AndrewHartman Good question -- so that seems like it would, effectively speaking, resolve to YES, at least for my purposes. There's certainly a hair to split for a pedant here -- is a total exemption of a category persisting under the same uniform rate the same as, or different from, no exemption of either category, but different rates for each category?

For me, it fulfills the spirit of the question and is a de facto split rate tax. The tax rate on buildings/improvements is effectively 0%.

Here's another way I see it -- if the market was asking, "Will Texas legalize the consumption of Marijuana?" and then instead of simply legalizing it, the state turned around and mandated its consumption, well mandating it is a subset of legalizing it, so it counts.

The essence of the question is, "will cities that want a split-rate property tax be able to have one", and I don't particularly care what each of the split rates are. If cities are forced to effectively have a split-rate property tax because of a universal exemption on buildings/improvements across the board, with an effective improvement rate of 0%, that counts for my purposes.

Is there any particular legal mechanism you think would bring this about? Last time I looked into tax abatements, they had a lot of limitations attached.

@LarsDoucet To be honest, I was asking mostly because I was curious about how often the major site users tend to be literal versus spiritual about their resolution criteria. By any literal reading, that would clearly resolve NO, but as the question you're actually interested in is "Will Texas change its tax code to make LVT possible?" I would expect it to resolve YES.

This tends to trip me up, in some situations, because I assume a literal reading of the criteria, without having the context behind why the market was made.

@AndrewHartman I think it's debatable that it would "clearly resolve NO" -- right now IIRC, Texas tax abatements are not allowed to be so universally broad and non-time-limited in nature, so for Texas to allow municipalities to pass such broad tax abatements to achieve what is in practice a split-rate property tax, would seem pretty clearly to amount to "legalizing a split rate property tax," because such a policy was illegal before, and now it is not, even if the mechanism that brought it about is a bit exotic.

But in any case, you now have a disambiguation of the resolution criteria I'm interested in. For better or worse, I care about the actual observable practical policy effects on the ground rather than the specific legalistic minutiae that get us there.