This market will forecast the interest rate for the @Tumbles Financial Complex.

Included are all loans meeting these criteria:

Tumbles is the debtor

At least M1k

At least 14 day term

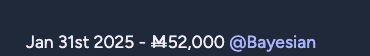

Due after market creation and by EoD 2024-01-31 AoE

Fixed non-zero interest rate, defined payment schedule, or similar defined at loan origination

Terms are public

No weird restrictions on use or whatever

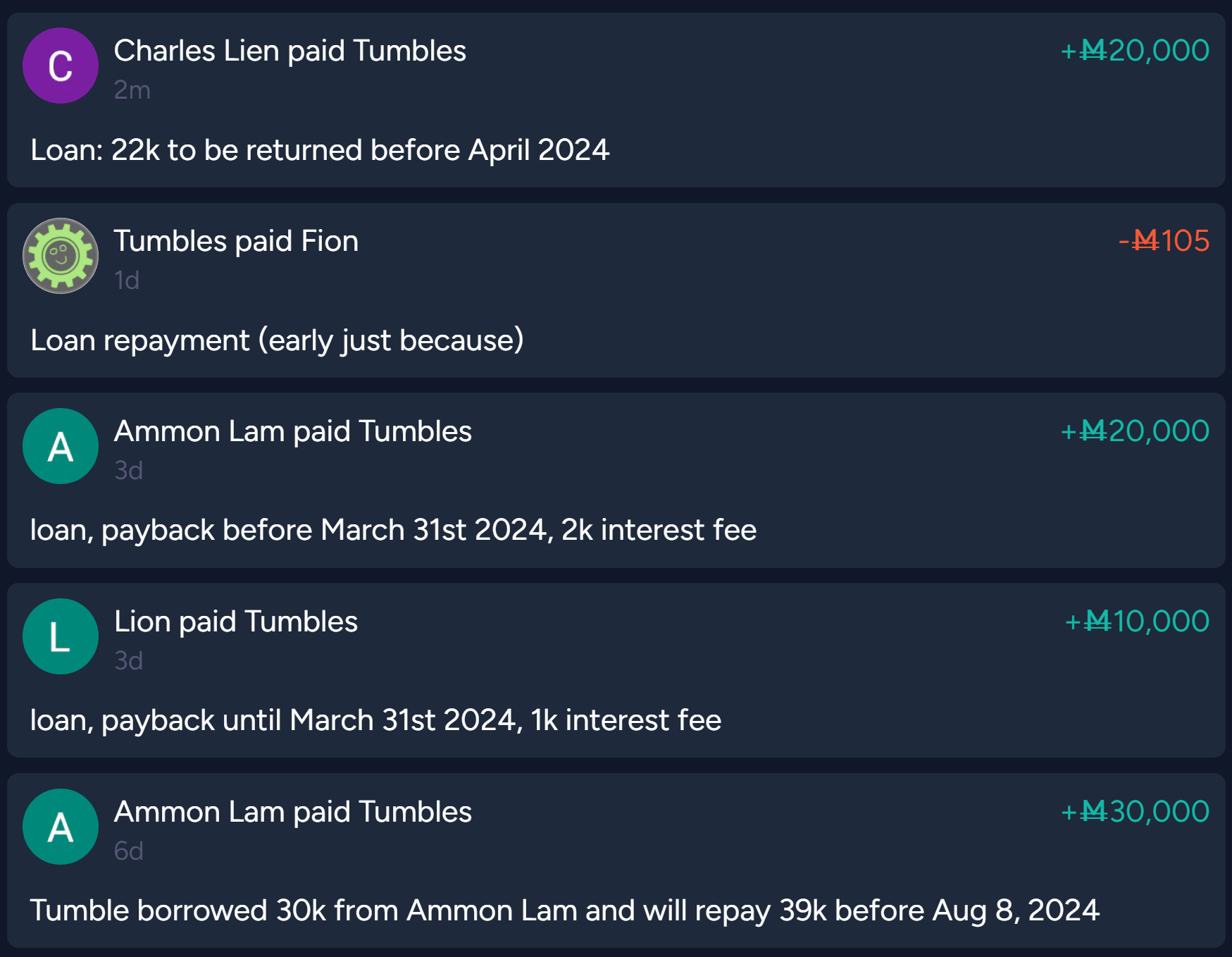

For each loan, the APR will be calculated. Loan duration will be calculated as a whole number of days. The final average APR will be computed by weighting the loans by duration * size of principle. That will then be used to resolve the individual derivative markets in the question group. See this spreadsheet for the technique being used. (Spreadsheet is not authoritative and may contain bugs or typos or not be up to date. Ask questions or something before relying on it. I have not tried to ensure the dates are exact.) I will post a tentative resolution shortly after market close and invite folks to verify the math before resolving.

As of question creation, the current APR value is 60.33%.

APR is calculated using a definition of "year" as 365 days but counting actual loan terms as actual number of days (inclusive of Feb 29th). This is weird and not ideal. For sake of not changing the math after market creation I'm just going to acknowledge it and leave it as is.

Unless otherwise specified, options refer to the APR calculated shortly after this market closes (2025-02-02). If earlier dates are specified, the same set of loans will be included, but only those in existence as of the date will be counted (whether the option resolves exactly on time or late).

"APR (linear)" option: The APR computed will be rounded to the nearest whole percent; it will resolve PROB to that number. Numbers > 100 resolve to 100, < 0 resolve to 0.

">= 50" and similar: resolves True if the APR is above the indicated number. Exact number, not rounded.

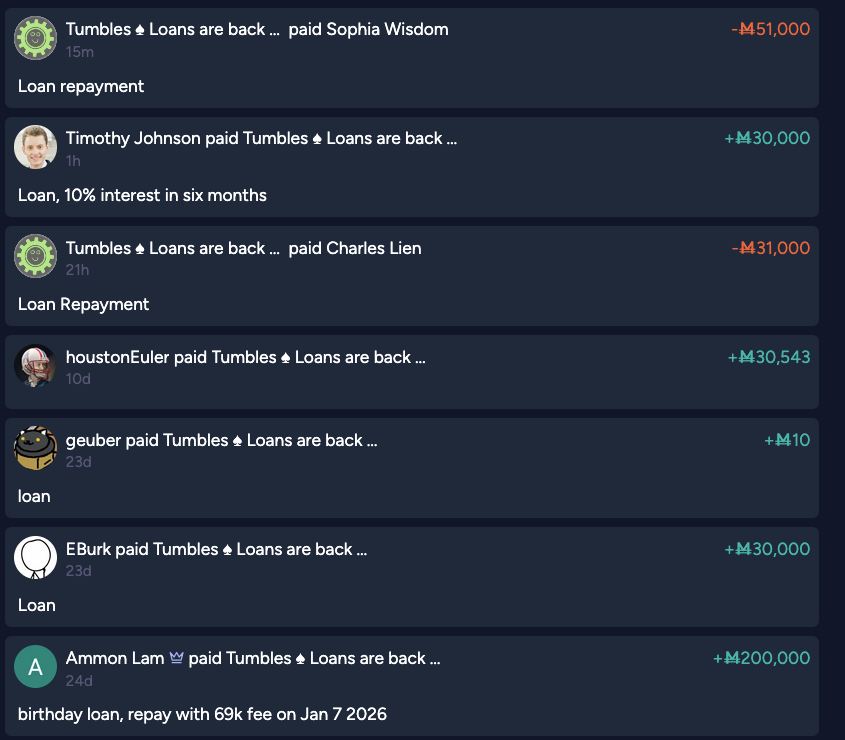

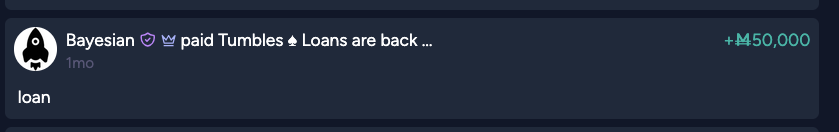

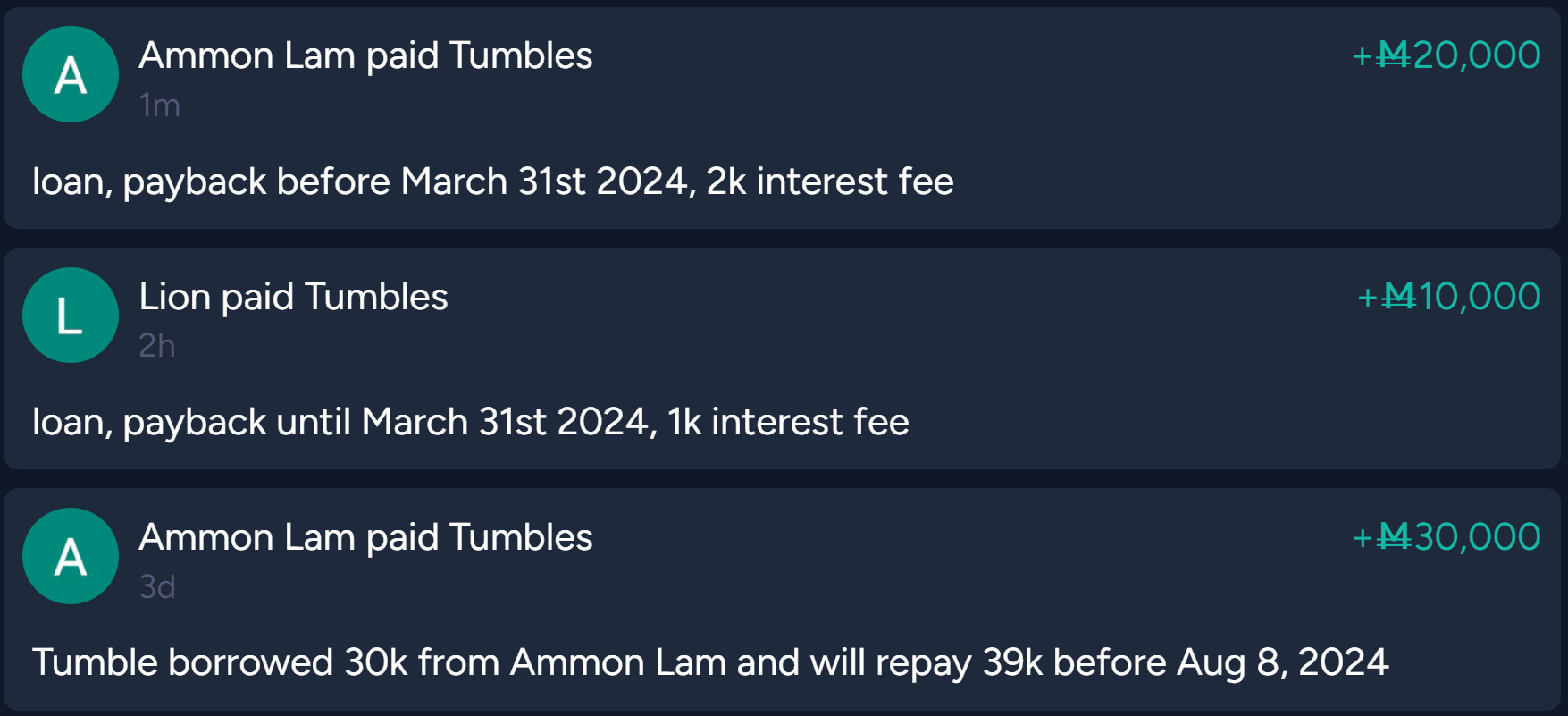

Loan list will be my best effort to include all such loans. Currently that means all loans listed here: /Tumbles/will-tumbles-ever-be-late-to-pay-ba , with my best attempt to determine dates based on Managram history. All publicly visible loans to Tumbles are included regardless of how the record keeping is done and whether they're on that market or not.

I'll add more options as they look interesting.

[This question is in draft mode; I'll fix typos or make minor tweaks to the methodology if I think that's appropriate. I intend to remove this draft notice in the next couple days and lock in the methodology. Feel free to remind me if I forget and this note is still here.]

This is pretty cool. Maybe some day the mana financial system will be a lot more sophisticated and there will be markets for bonds, and equities and manifold will set the mana interest rate 😭 sounds awesome. @Tumbles you should consider selling equity/shares of yourself and also bonds 🥴

@DylanSlagh Mira once owned half of my account over a period of time, but they gave it all back. I think personally loans with interest rates independent of my profit are more fun than selling shares of my account, but derivative markets on my account and my loans are obviously very fun to me hehe

I keep updating this as more loans come in LOL

Tumbles and I have made a variable-rate loan based on this value. M2k principle, to be repaid by 2024-07-08 (a week after this value is finalized). This loan is not included in the calculation above, because it is not a fixed-rate loan. As of loan origination, the benchmark rate is 60.33% APR. Loan rate to be calculated on a continuous compounding basis, so for the current APR Tumbles will owe me M2534. Amount due will change if Tumbles takes out new loans that meet the criteria for inclusion. See the spreadsheet for calculation method.

I'm presuming that Tumbles will be honest and public about all loan terms, or clear that a loan has non-public terms (in which case I won't include it in this market). Tumbles (or anyone else) is welcome to manipulate the interest rate of the market by making more loans, but not with hidden payments (kickbacks, interest, etc.).

The loan documented here is included; it has a lower nominal rate than others for structural reasons, but that's fine. Other such loans will also be included. /EvanDaniel/will-tumbles-repay-m13500-to-evanda

My loan to Tumbles for use on nuclear risk markets is not included. It's a nominal zero rate loan, and has weird restrictions, both of which disqualify it.

I plan to continue trading on this market, so I'm trying to be very clear and specific about how the result will be calculated. Please let me know if anything isn't clear.

From Discord discussion:

Gabrielle: Mira cancelled her loan to Tumbles when she quit the site, so just a free 100k for Tumbles

Tumbles: Note that I also inherited a 32k debt to Genzy, so more like a free 68k

Evan: But for the sake of the above market I should probably just ignore both of those things?

Tumbles: ya probably. The Mira loan had a really weird structure in the first place as well

Those loans will not be included in this market's calculation.